Author: Réka Sulyok

- Woes over energy security prompted Central Europe to turn back to coal and lignite.

- In the Visegrad 4 region Hungary is the most recent state to make a U-turn on coal. Their announcement comes on the heels of the Poland’s plans to stick to coal well beyond 2049 foreshadowing a not-so-short term return to coal.

- Gas scarcity in the coming quarters is likely. The heavy industries could fall victim of the rationing this winter season.

Caught between a rock and a hard place, Central Europe reverts course on coal phase-out. True, moving away from coal has been sluggish and came to a halt amid COVID and broadening energy commodity price increase. The soaring gas prices combined with a jump in the price of carbon made coal all the more attractive: From late summer of 2021 coal emerged as the cheaper input to power generation. That is, emission allowance costs did not rise as much as gas prices did. Well before the Russian war against Ukraine the price incentives were there to switch back to coal.

The most recent announcement came from Hungary and triggered by the fears that Nord Stream 1 deliveries can come to a halt. In Hungary, the lignite fueled Mátra plant’s production will be ramped up (capacity of 950 MW) to secure energy safety in the immediate run. The plant is scheduled to retire in 2025 according to the climate pledges made by the government in 2021.

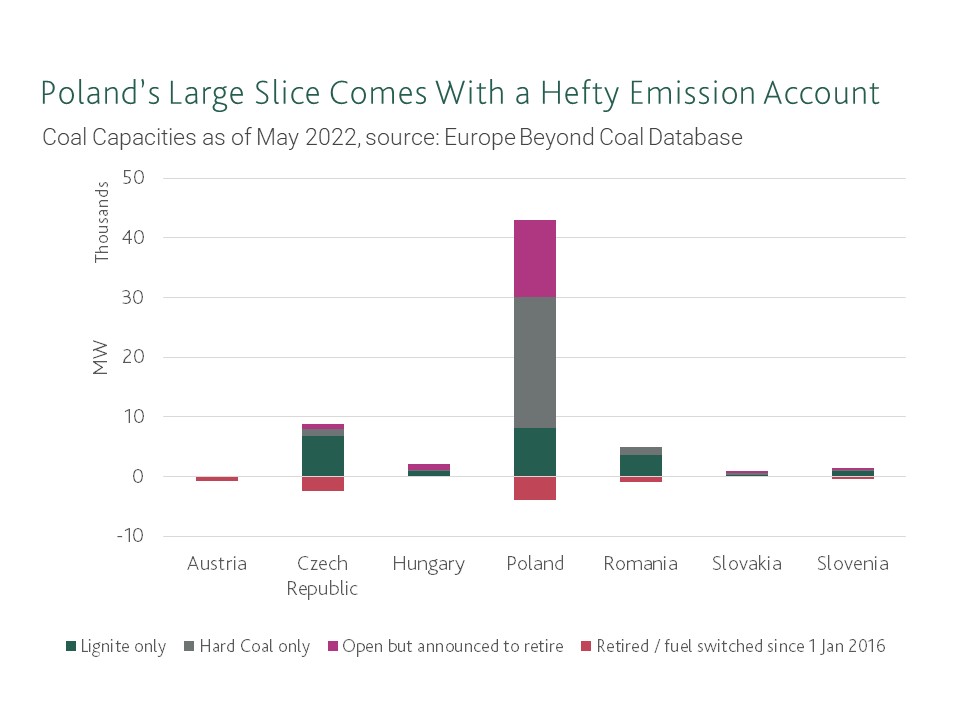

Back in 2021, Poland shut down coal capacities of 450 MW (Rybnik) while Czech Republic a hefty 656 MW (Melnik 610 MW, Plana 46 MW). High and rising gas prices through last year, however, gave a jolt to coal power plants: Their share in the Czech electricity production increased by 11% from a year ago which increased import capacities towards Austria. Similarly, Poland’s coal power output has been on the rise printing at a solid 7% since 2019. Not only did Poland top the EU-27 chart of coal-based power generation since 2019, but the country continues to rank high on the CO2 emission table. The top 10 EU emitters list has Polish and German coal power-plants.

More daunting is that there is not much of an improvement in sight. The plans to reduce coal capacities to 3.4 GW by 2040 in Poland seem to have gone out of the window. In spring the government announced plans to rely on coal in electricity generation beyond 2049. What’s more, Polish government put forward a plan to introduce a temporary carbon price regulation. They propose to set the price of CO₂ emission allowances at €30 for at least a year to alleviate the cost push on the energy system. That suggested fixed price is a far cry from the current levels hovering around €80-90.

The hard-to-abate industrial sectors which we cover in our project predominantly use coal and gas as feedstocks. The chemical industry’s exposure to the fossil fuel shock is the most pronounced as it also uses oil as an input and transform it into refined products in a process that requires heat. Petrochemical producers then might face a hard landing: High input prices and a recessionary environment could chip away the revenues and profit margins. And then the impeding gas shortage could mean a temporary, but months-long halt in production leaving the companies cash-strapped. Given the predominant downstreamness of the CEE industries there is a higher risk to experience a protracted period of output drags in a worst-case scenario.

All in, the energy intensive industries will deal with a blow which can force decarbonization investments to stop. The funding squeeze if gets more entrenched is a serious threat to the green transition. Not only is this going to halt any meaningful short-term action of the industries but the economic fallout of the supply disruptions in manufacturing will also likely corner the policy makers. We need to zero in on the long term objectives and commitments caught between coal and a rock and a much harder place.

More insights

Second high-level impact lunch in Budapest

The Equilibrium Institute held its second high-level impact lunch in the framework of the project on 2 October 2023.

The Industry Taskforce

The Taskforce will pool key decision makers and power brokers from the region to provide expert input, peer review for research and act as ambassadors of the project.